Uncovering JAPA

Locating Housing Affordability Amid Foreclosures

It's been years since the foreclosure crisis and still, not all communities have recovered. But why?

Authors Kyungsoon Wang and Dan Immergluck put forward a possible explanation in their article "Neighborhood Affordability and Housing Market Resilience," in the Journal of the American Planning Association (Vol. 85, No. 4).

Neighborhood Affordability and Housing Resilience

Decisions about where to live are largely made considering housing and transportation costs. Together, these two costs interact to determine an area's location affordability. The Department of Housing and Urban Development suggests that location affordability should not amount to more than 45 percent of a household's income.

In this article, Wang and Immergluck study the relationship between location affordability in more than 300 metropolitan areas in the United States and foreclosure rates before and after the foreclosure crisis.

The authors find that changes in both urban form and market conditions have an impact on resilience to foreclosure.

Specifically, their work illuminates that foreclosure resilience is more likely to be found among central cities and high-density areas in strong and weak market metros and suburban low-density areas in boom-bust market metros. These spaces have largely seen their housing market systems bounce back to conditions before the crisis.

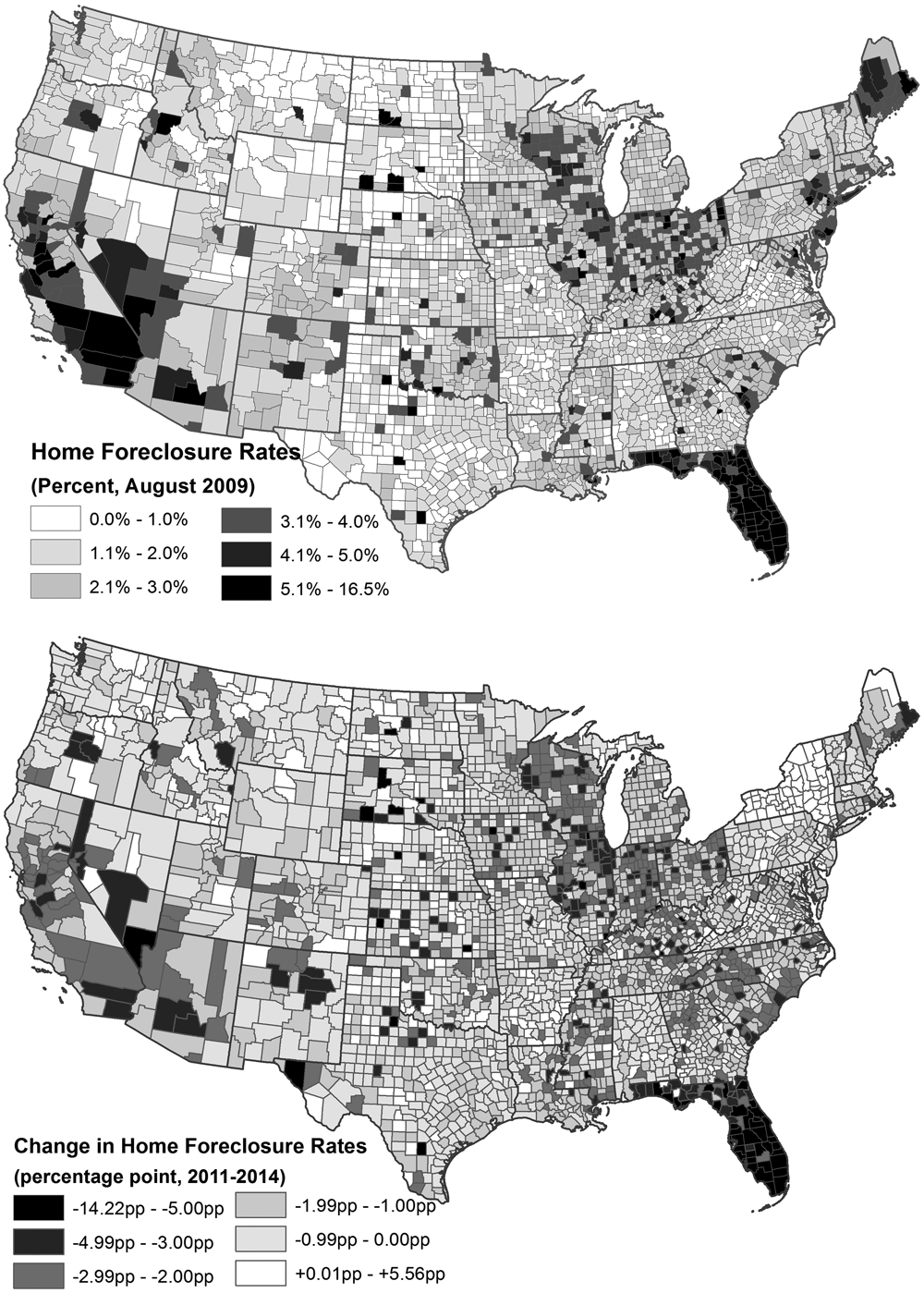

In August 2009, many counties in Florida and California, perhaps the hardest affected by the crisis, had foreclosure rates greater than 5 percent. Yet, these counties also demonstrated the greatest resiliency. By August 2014, many of these same counties had foreclosure rates of less than 1 percent.

Geographical distribution of county-level home foreclosure rates in August 2009 and (bottom) changes in county-level home foreclosure rates between August 2011 and August 2014. Source: County-level foreclosure data from Black Knight (formerly LPS Applied Analytics). From "Neighborhood Affordability and Housing Market Resilience," in the Journal of the American Planning Association (Vol. 85, No. 4).

Location Affordability and Foreclosure Resilience

While emphasizing the importance of overall location affordability, the authors find that in specific contexts certain costs are better predictors of foreclosure resilience.

For central cities and high-density areas, affordable transportation had a great effect on whether an area was resilient to foreclosure.

However, in suburban low-density areas, lower housing costs were associated with greater foreclosure resilience. In fact, in these spaces, greater transportation affordability was associated with less foreclosure resilience, not more.

Ultimately, Wang and Immergluck suggest that planners may create communities more resilient to foreclosure by addressing location affordability. They specifically highlight the need to densify housing in already affordable areas.

However, is this enough? Densifying, especially in communities without inclusionary zoning measures, may push out low-income households who benefit from this tradeoff of housing and transportation costs. This, however, is not to deter planners from producing additional stock.

Instead, as location affordability is the combination of housing and transportation, it is a reminder that planners must simultaneously invest in improving housing and transportation affordability if they hope to create foreclosure-resilient communities.

Top image: Foreclosure sign in 2008. Wikimedia Commons photo (CC BY 2.0).