Capital Improvement Programming

PAS Report 151

Historic PAS Report Series

Welcome to the American Planning Association's historical archive of PAS Reports from the 1950s and 1960s, offering glimpses into planning issues of yesteryear.

Use the search above to find current APA content on planning topics and trends of today.

|

AMERICAN SOCIETY OF PLANNING OFFICIALS 1313 EAST 60TH STREET — CHICAGO 37 ILLINOIS |

|

| Information Report No. 151 | October 1961 |

Capital Improvement Programming

Download original report (pdf)

Capital improvement programming is the scheduling of public physical improvements for a community over a certain period of time. The scheduling is based on a series of priorities, according to the need, desire or importance of such improvements and the community's present and anticipated financial standing.

Capital improvement programming is the vital bridge between the comprehensive plan and the actual construction of public improvements. Because of the great influence that the provision, nature and location of public facilities have on the pattern of urban growth, programming is probably the most important implementation tool at the planner's disposal. Whereas the zoning ordinance and subdivision regulations guide certain aspects of private development, the capital improvement program can have a proportionately greater impact on urban development since decisions whether certain improvements are built at all are made.

Because ASPO Planning Advisory Service Information Report No. 23, Capital Improvement Programming — Some Considerations (February 1951), has been out of print for quite a while and the number of subscribers to Planning Advisory Service has more than tripled since it was published, a revision of that report seems timely. Only about one-fourth of the cities in the U.S. with over 10,000 population have capital improvement programs1 (and it is doubtful if even a significant proportion review them annually), so perhaps this report may arouse some renewed interest in a technique that has been known for decades.

Discussion will move from some general considerations to elements of financial analysis, general procedures, and to the fundamental problem of programming: the selection of priorities. In addition, some examples of legal provisions concerning capital programming are presented.

GENERAL CONSIDERATIONS

Advantages of Capital Programming

There are many benefits to be gained by capital improvement programming. To make a list of the advantages is useful not only to encourage programming, but to use as a guide and measuring device in the process itself. Thus, when a stated advantage is "to take better advantage of grants-in-aid from other governments" the planner is at the same time alerted to explore all the possible aid programs in which the city may be eligible to participate. The list is as follows:2

1. In conjunction with the master plan of the community, programming safeguards against public improvements being misfits and liabilities upon the city in lieu of assets.

2. Programming allows a stabilization of the tax rate over a period of years.

3. It also allows a stabilization of personnel demands. The number of personnel can be reduced and better trained.

4. Adequate time for planning and engineering of improvements is another advantage. Slack periods can be better utilized by these personnel to work ahead on the needs of the community in the order of priority.

5. Programming and advance planning call attention to the deficiencies of the community and stimulate action to correct them.

6. It enables citizens to take a long-range view of their future activities and responsibilities.

7. Programming inherently promotes a coordination of construction activities of overlapping and contiguous governmental jurisdictions.

8. Programming aids in assuring that projects are not undertaken too soon before the need arises nor too late after land costs are inflated.

9. The very nature of the entire procedure protects the community against undue influence of pressure groups pressing for pet projects.

10. It will enable the city to take better advantage of federal and state grants-in-aid. Plans can be prepared far in advance and matching money made available to take advantage of anticipated and unanticipated grants-in-aid.

11. It will also enable the city to undertake additional projects scheduled for later years in a period of surplus revenues should such a situation arise.

12. As stated above, the city can acquire land needed for improvements while cost is low.

13. Insuring the maximum benefits from the money spent can be said to be both a purpose and an advantage.

14. Programming insures that funds can be organized in advance in a more logical manner.

15. Where an election will be necessary, it enables the city to secure public support and acceptance in advance, assuring a higher degree of voter approval.

16. Impartial treatment can be given to all sections of the community.

17. A community that has prepared a program that is based on a comprehensive community plan will put town officials, the budget-making authority and others in very strong positions to justify needed improvements.

18. The program will make available to every department the programs of all departments so that informed decisions can be made and joint programs initiated.

19. Similarly, it will make available to other governmental agencies, privately managed public utilities, and other public groups a comprehensive view of the intentions of the city so that they, too, may make sounder judgments concerning construction programs.

20. Concentration or overemphasis upon any single project to the exclusion of others, perhaps more essential, may be avoided and a more balanced development achieved.

21. Stabilization of the volume of public improvements at a reasonably uniform level will have a beneficial effect upon employment in the local construction industry and the related supply industries.

22. Impetuous action caused by a momentary wave of popular enthusiasm can be best avoided.

Definitions

Budget or Program? Although there seems to be general agreement about certain definitions in the literature of method and procedure of capital improvement programming, there is not a corresponding agreement on some of the terms used in the actual capital program documents that are published, nor in the writings of those who are closely associated with active ongoing programs.3 The "book" definitions are as follows:

Capital Improvement Program — A list of all proposed projects, together with the priority of their construction. The time span is "indefinite" or the "foreseeable" future.

Capital Budget — A list of projects together with priorities and specific means for financing. Time span is five or six years. The first year is adopted within the annual municipal budget.

Annual Operating Budget — Expenditures for operating, recurring services for a period of one year.

Public Services Program — A long-range plan for public services. An extrapolation and extension of the operating budget. Time span is indefinite.

Long-Term Revenue Program — A tentative revenue policy to finance operating and capital expenditures. Time span is five or six years.

Perhaps a discussion of definitions is a "small" point. However, there seems to be much unnecessary confusion brought about by the use of certain terms. In particular there is an inconsistency between the words "program" and "budget" in reference to the time factor. In almost every financial context, a budget refers to a period of one year. Calling something five or six years long a budget is somewhat misleading, especially since long-term plans for revenues and public services are called programs while their annual counterpart is called a budget. In addition, the current practice in our major cities that regularly practice capital programming is to refer, in both publications and local legislation, to the six-year period as a capital program and the first year of that program as a capital budget. Consequently, in order to avoid using the same word in different contexts and to retain meanings as similar as possible to common everyday meanings, this report will refer to the six-year period as the capital improvement program and the one-year period as the capital improvement budget.

Perhaps one is left with the problem of what to call the list of capital improvements, sometimes called the capital improvement program but without a name in this report. For the sake of simplicity again, this will be referred to as the list of capital improvements suggested for the foreseeable future.

What is a Capital or Public Improvement? The usual definition of a capital improvement includes new or expanded physical facilities for the community that are of relatively large size, are relatively expensive, and relatively permanent. Such items as streets, playgrounds, harbor facilities, police stations, schools, libraries and sewer systems are considered capital or public improvements. Large-scale replacement or rehabilitation of existing facilities also fall within the definition. Whether equipment is also considered to be a public improvement depends on the type of operating budget under which the community functions. For example, a major piece of equipment such as a fire engine is in the "twilight zone" — some communities (particularly the smaller ones) would classify it as a capital improvement, others would not. The engine has a direct relationship to the fire station in which it is housed, and to the function of the fire station; it also is relatively expensive and of relatively long life. It is, of course, not as fixed nor as expensive, nor as long in life expectancy as the station. However, the engine could be contrasted to office equipment used within the fire station. Office equipment would generally be considered an operating expense and would be included as a part of a capital improvement if an office were to be furnished all at one time in conjunction with a new or expanded facility.

The terms "capital improvement" and "public improvement" are used interchangeably in the literature and will be so used in this report. In some circumstances, distinctions have been made (particularly for accounting purposes) that refer to capital improvements as any expenditure for the purpose of increasing the physical assets of a community. This term would obviously include capital improvements, while "public improvement" would be reserved for the building or structure-type physical facility. Thus, public improvements would be included in the term "capital improvements," while the reverse would not be true. Such preciseness is not followed in this report, but this distinction should be made in the programming process.

The planning agency charged with preparation of the capital improvement program will want to consult with the financial agency of the community to establish agreed-upon definitions of what constitutes a capital improvement.

In addition to the distinction between structures and equipment, it is desirable that consideration be given to establishing certain standards of measurement, perhaps even arbitrary ones, so that there will be consistency in differentiating between capital improvements and operating expenses. For example, one type of standard would be that all physical items involving expenditures of more than $1,000, or having an anticipated life of 10 years or more, would be considered as capital improvements. Agreements should be reached, for example, on whether street repaving should be included or excluded from the definition; or whether the widening of existing streets or just the opening of new streets should be included.

While costs for personnel to operate the facilities are not a part of capital improvement expenditures, the personnel costs of engineering and architectural work is a legitimate charge to the project and would no more be divorced from the finished product than the land acquisition, construction labor, or material costs. Thus, detailed planning for a project is considered in the total cost of the project.

Time Period

Generally, capital improvement programs are set up for a six-year time period with annual review. Although this time period is frequently selected by public agencies, it is not based on a scientific determination that this is the optimum period of years for forecasting the capital requirements of a community. It is a convenient period of time, manageable for purposes of analysis and arrived at by elimination of alternatives.

A one- to three-year program is of too short duration for most cities and would defeat the purpose of being "long-range." If four years were chosen, the capital improvement program might coincide with an election year. Turning the capital program into a political football could result from such a procedure, as well as making program continuity more difficult. Since a "five-year plan" has a well-known international connotation, a six-year period has been traditionally chosen. Although periods as long as ten years have been used by a few communities, the overwhelming tendency has been to follow the early recommendation of the National Resources Planning Board. The NRPB favored a five- or six-year program.

FINANCIAL ANALYSIS

The ability of a community to pay for proposed capital expenditures is too often overlooked by planners. To be realistic, any capital improvement program must be formulated within the framework of the financial capacity of the city to pay for its needs and desires. To propose improvements the community cannot afford, or to propose improvements without some idea of how they will be paid for, is an exercise in futility.

In its classic report4 the National Resources Planning Board stated that the fundamental purpose of a financial analysis is to

...determine approximately the present and future ability of the municipality to pay for the construction and maintenance of public improvements, by estimating the present availability of funds, by research into the probable future trends of municipal revenue and expenditure, by appraisal of all factors related to the administration and operation of the program, and by determining what limitations are imposed, by statutes or prior commitments, upon the freedom of the municipality to act. This amounts in reality to comprehensive financial planning for the city.

Although primary responsibility for financial analysis rests with the chief finance officer, the planner should understand some of the basic and elementary facets of measuring the financial capacity of the city. In the smaller community, he may have to assume part of the responsibility for such studies. Perhaps the planner is limited in his ability to interpret much of the results of such a study. But he can collect some of the basic data as part of the tooling-up studies he normally carries on in anticipation of plan preparation. In the smaller community, the finance office is often a one-man operation without the aid of research staff. The planner, whether resident or consultant, can gather much of the necessary information for the more expert analysis of the finance officer and for joint study and use.

That the planner can do this does not seem unreasonable in the light of the kind of economic and social data needed for comprehensive financial analysis and planning cited in Municipal Finance Administration.5 The list is parallel to and in some cases identical with typical planning studies:

1. Population — probable population growth or decline, age distribution, movements to and from incorporated areas, and school enrollments....

2. Area growth — land area of the city and annexation proposed and in process.

3. Housing — number of dwelling units, building permits, location of new units, percentage of vacancies, and so on.

4. Labor force — employment in industrial, commercial, and service establishments, and ratio of unemployed to total labor force.

5. Wealth and income — estimates derived from assessed valuations, true values, bank deposits, automobile registrations, and other indicators.

6. Economic characteristics — an inventory of assets and liabilities in the community for industry, commerce, service establishments, and transportation. The stability of employment and the economic base through industry diversification is an important element in such an analysis.

7. Municipal finance — assessed valuation, tax collections, tax collection ratios, ratio of municipal debt to assessed valuation, per capita debt, and welfare costs.

8. Other data, depending on need, can be compiled on price level and construction cost indexes, utility installations, and motor vehicle registrations.

For the purpose of discussion, the financial analysis can be divided into three phases:

1. Study and projection of revenues.

2. Study and projection of expenditures.

3. Development of fiscal policies.

Revenues

All sources of municipal revenue should be examined and projected. One convenient method of classification would be the following:

1. General property taxes.

2. Income or sales taxes.

3. Licenses, fines, permits and fees.

4. Service charges.

5. External government aid and shared taxes.

6. Other miscellaneous sources.

Each of these sources should be traced far back enough to account for recessions and booms. They then should be related with appropriate indexes so as to make future estimations. For example, property taxes would be based on projected residential, commercial, and industrial construction rates with an assumed market value, the relationship to assessed value, and tax rate (for purposes of analysis, the existing tax rate should remain constant); projected income taxes based on an estimate of future personal income; automobile taxes dependent upon the relationship between future population and car registrations; and other similar methods of estimating future municipal income within each classification.

Table 1. Assessed Valuation and Revenue From Real Property Tax: Past Trends and Future Estimates

| Year | Assessed Valuation | Tax Rate in Mills | Tax Levy | Total Collected | Per Cent Collected |

|---|---|---|---|---|---|

| Past Trends | |||||

| 1951 | $ 6,343,241 | 8 | $ 50,746 | $49,743 | 98.0 |

| 1952 | 6,922,795 | 8 | 55,025 | 52,032 | 94.5 |

| 1953 | 7,359,355 | 8 | 58,874 | 58,430 | 99.2 |

| 1954 | 8,250,940 | 12 | 99,011 | 92,070 | 92.9 |

| 1955 | 8,835,350 | 12 | 106,024 | 103,834 | 97.9 |

| 1956 | 9,387,340 | 15 | 140,811 | 134,837 | 95.7 |

| 1957 | 9,897,735 | 15 | 148,467 | 142,207 | 95.7 |

| 1958 | 14,819,136 | 15 | 192,651 | 185,857 | 92.6 |

| 1959 | 15,424,616 | 13 | 200,522 | 187,371 | 93.4 |

| 1960 | 15,750,251a | 13 | 204,753a | 199,645a | 97.5 |

| Future Estimatesb | |||||

| 1961 | 16,278,000 | 13 | 211,614 | 201,000 | 95.0 |

| 1962 | 16,806,000 | 13 | 218,478 | 208,000 | 95.0 |

| 1963 | 17,334,000 | 13 | 225,342 | 214,000 | 95.0 |

| 1964 | 17,862,000 | 13 | 232,206 | 221,000 | 95.0 |

| 1965 | 18,390,000 | 13 | 239,070 | 227,000 | 95.0 |

| 1966 | 18,918,000 | 13 | 245,934 | 234,000 | 95.0 |

1– Includes current and delinquent receipts.

a – Budget Estimates.

b – Estimates of future assessed valuation are based on a projected residential construction rate of 60 homes per year and an assumed market value of $16,000 per home. No attempt has been made to predict fluctuations in the relationship of market value to assessed value; an assumed ratio of 55% has been used. Thus, the projected annual increase in assessed value is $528,000.

Source: Pittsburgh Regional Planning Association, A Master Plan for the Borough of White Oak, 1960, p. 151.

Table 1 is reproduced from a master plan report for a town of less than ten thousand population, and illustrates past trends and future estimates of revenue from the local real property tax. Footnote "b" should be particularly noted since it contains the assumptions used in arriving at the future estimates. This information is then combined with estimates of other sources of income in Table 2, reproduced from the same report. Footnotes "f" through "j" should be especially noted since they state the basic assumptions used in projecting each class of revenue.

Table 2 Summary of Borough Receipts: Past Trends and Future Estimates

| Year | Real Estate Tax Revenue | Amusement Tax Revenue | Deed Transfer Tax Revenue | State Gasoline Tax Grant | Other Revenue & Non-Revenue Receipts | Total Receipts |

|---|---|---|---|---|---|---|

| Past Trends | ||||||

| 1951 | $ 49,811 | $ 8,318 | $11,748 | $ 6,116 | $25,228 | $101,221 |

| 1952 | 52,045 | 8,315 | 18,828 | 4,758 | 13,265 | 97,211 |

| 1953 | 58,430 | 9,951 | 26,732 | 4,750 | 13,389 | 113,252 |

| 1954 | 92,070 | 10,594 | 10,737 | 5,530 | 17,022 | 135,953 |

| 1955 | 108,834 | 8,970 | 18,349 | 5,513 | 13,559 | 155,225 |

| 1956 | 134,827 | 7,097 | 24,634 | 11,786 | 14,592 | 192,936 |

| 1957 | 144,918 | 7,243 | 19,247 | 14,105 | 20,986 | 206,499 |

| 1958 | 185,857 | 14,581 | 21,946 | 14,152 | 12,930 | 249,466 |

| 1959 | 187,371 | 7,911 | 21,153 | 16,907 | 26,896 | 260,238 |

| 1960 | 199,645 | 9,127 | 15,000 | 16,862 | 21,825 | 262,459 |

| Future Estimatesb | ||||||

| f | g | h | i | j | ||

| 1961 | 201,000 | 9,000 | 20,000 | 17,000 | 13,000 | 260,000 |

| 1962 | 208,000 | 9,000 | 20,000 | 17,000 | 13,000 | 267,000 |

| 1963 | 214,000 | 9,000 | 20,000 | 17,000 | 13,000 | 273,000 |

| 1964 | 221,000 | 9,000 | 20,000 | 17,000 | 13,000 | 280,000 |

| 1965 | 227,000 | 9,000 | 20,000 | 17,000 | 13,000 | 286,000 |

| 1966 | 234,000 | 9,000 | 20,000 | 17,000 | 13,000 | 293,000 |

f – See Table 1 for derivation of increases in real property revenues.

g – Projection based on average receipts in adjusted dollars between 1951 and 1959.

h – Based on average adjusted receipts between 1955 and 1959, on assumption that the real estate marked during Stage One will resemble activity between 1955 and 1959.

i – Future receipts from the state gasoline tax grant will depend upon the total size of the state appropriation and the formula for apportioning this sum among municipalities. Because there is no assurance of future increases comparable to those of the last decade, a constant amount is assumed as White Oak's share between 1961 and 1966.

j – special assessment receipts are not included in projection. Capital outlays financed through special assessments are excluded from summary and projection of expenditures also.

Source: Pittsburgh Regional Planning Association, A Master Plan for the Borough of White Oak, 1960, pp. 153–54.

A word of caution concerning forecasting is given in Municipal Finance Administration.6 It states that information

...can be projected by the use of one or more statistical techniques, but it is here that one of the major possibilities of error in long-term financial planning exists. Three basic methods are usually used for forecasting: extrapolation, correlation, and some form of analytic technique. All three of these statistical techniques should not be used by amateurs. In forecasting, it is far better to give weight to all possible factors that may change past developments and to arrive logically.at future estimates, than to rely upon a statistical formula for computing a future trend. The latter is too mechanical and too dangerous. Careful forecasting often requires extensive compilation of data and very careful analyses and interpretations, but this will probably be sound economy for the city in the long run.

Detailed study and discussion also should be made concerning possible changes in tax rates, constitutional or statutory limits on rates, sources of revenue available to the locality, various policies concerning revenue-producing departments or projects, types of grants-in-aid available from other units of government, possible changes in state laws that may affect sources of revenue, and the presence of inflexibility because of earmarked funds.

Expenditures

For analytical purposes, expenditures should be broken down into three categories: operating expenses, debt service, and capital improvements. Each category has special characteristics that must be examined separately in order to arrive at a logical and accurate assessment of the nature of the local financial structure.

Operating Expenses. Operating expenses usually take the largest portion of municipal income and consequently have an important relationship with all other expenditures. In particular, the amount of operating expenditures limits the amount available for capital improvements whether they are paid for in whole or part in cash, or by borrowing with the resulting debt service costs coming from current revenues.

As is the case with the analysis of revenues, expenditures should be traced back far enough to gain adequate historical perspective. The data should be classified by function, department or fund, and should be broken down into sufficient detail so as to clearly indicate the trend of each individual function. For example, "recreation" may be too broad in scope and ignore important differences between the relative emphasis and resulting differences in operating and maintenance costs between indoor recreation centers and outdoor playfields.

While there has been progress in recent years in capital improvement programming, there has been no corresponding attention given to the planning of the operating budget. Although such planning is necessary if financial support for the capital program is to be realistically estimated, the task has largely been left undone because of the admitted difficulty of accurately estimating both revenues and expenditures very far into the future.

However, there are two important reasons for preparing the operating budget with a long-range view.

One reason is to make very clear to legislators, administrators, and citizens that there is a fundamental difference between expenditures for continuing operating requirements and expenditures for capital improvements which are nonrecurring and of enduring value. Once this fundamental difference is made clear, much of the misunderstanding which frequently stands in the way of good capital budgeting will be removed. A second reason for a long-term operating budget is the practical problem of keeping total costs of regular operations and capital improvements within the limits of sound financing and a reasonably uniform tax rate. This can hardly be accomplished unless an estimate is made of future operating costs including the additional costs of operation of contemplated capital improvements.7

Estimation of future operating expenditures should be based on past experience adjusted to increases in population, increased personnel and equipment costs, inflation and any changes in the public service program. In general, substantial changes in operating expenses occur because of corresponding changes in service. "Once it is determined, for example, that the fire department needs five engine companies and two ladder companies, and that the companies should be manned with an average strength of ten men, the budget of the fire department is practically determined. It can be reduced substantially only by reducing the number of companies or by reducing the average manpower per company, that is, by lowering the level of the service provided."8 Similarly, the influence of the capital improvement program should also be taken into account when projecting operating expenditures. For example, one city carried out a comprehensive playground construction program that gave the city over fifty new facilities. No plans had been made to finance the expenditures needed to staff and operate the playgrounds. The result was a considerable burden on the annual operating budget. Table 3 is an example of the projection of operating expenditures.

Table 3. Summary of Borough Expenditures: Past Trends and Future Estimates

| Governmental Operating Expenditures: | Non-Governmental Expenditures: | ||||||

|---|---|---|---|---|---|---|---|

| Year | General Government | Protection to Persons & Property | Health & Sanitation | Streets & Highways | Misc. | Debt Service | Misc. |

| Past Trends | |||||||

| 1951 | $19,258 | $12,260 | $17,480 | $31,124 | $2,013 | $4,200 | $265 |

| 1952 | 18,713 | 16,987 | 16,743 | 36,092 | 2,789 | 5,490 | — |

| 1953 | 19,933 | 20,793 | 19,753 | 35,130 | 3,741 | 7,635 | — |

| 1954 | 17,331 | 25,267 | 20,952 | 29,099 | 29,136 | 13,545 | — |

| 1955 | 20,687 | 31,145 | 21,736 | 36,208 | 23,297 | 13,255 | — |

| 1956 | 30,053 | 38,555 | 21,465 | 54,236 | 57,166 | 13,145 | 1,316 |

| 1957 | 28,675 | 38,965 | 20,290 | 58,205 | 5,178 | 16,155 | 43 |

| 1958 | 34,674 | 31,732 | 22,741 | 63,871 | 9,939 | 16,250 | 1,669 |

| 1959 | 43,752 | 41,189 | 22,182 | 51,348 | 13,191 | 15,645 | 4,548 |

| 1960 | 41,138 | 46,345 | 22,250 | 81,125 | 49,928 | 15,440 | — |

| Future Estimates (excluding capital improvements recommended in master plan) | |||||||

| h | h | i | h | j | k | ||

| 1961 | 49,000 | 48,000 | 24,000 | 61,000 | 8,000 | 20,500 | — |

| 1962 | 52,000 | 51,000 | 24,000 | 66,000 | 8,000 | 20,100 | — |

| 1963 | 55,000 | 55,000 | 24,000 | 71,000 | 8,000 | 19,700 | — |

| 1964 | 57,000 | 58,000 | 26,000 | 76,000 | 8,000 | 19,300 | — |

| 1965 | 60,000 | 62,000 | 26,000 | 81,000 | 8,000 | 18,900 | — |

| 1966 | 63,000 | 65,000 | 26,000 | 86,000 | 8,000 | 18,400 | — |

h – Projection based on average adjusted yearly increase between 1950 and 1959.

i – Based on a $2,000 increase every three years in cost of garbage collection.

j – Does not include an allowance for future unpaid bills. Does include an allowance for interest on temporary loans as well as $7,000 for insurance and other miscellaneous items.

k –1960 debt service includes payment of interest and principal on bond issue of 1960 as well as issues of 1950, 1952, 1953, 1956. No new bond issues are included in this projection.

Source: Pittsburgh Regional Planning Association, A Master Plan for the Borough of White Oak, 1960, pp. 155–56.

Debt Service. A compilation of all outstanding municipal debts at the end of the current year should be made in order that future requirements for debt retirement can be determined. The tabulation should be extended into the future to that point in time when all existing debt is liquidated. It would then be known how much is needed each future year for debt service. A chart should be prepared that shows the constitutional or statutory debt limit, total debt service, principal, and interest. Any new debt that is to be incurred must be within the financial capacity of the community. That is, the total debt cannot go over the legal limit (which may or may not be the amount that financial prudence would dictate) and cannot be incurred in such a way that debt service would be disproportionate to the operating budget. An increase in debt service decreases the amount of funds available for current public services. A comparison must be made between proposed capital improvements, any new debt service that may be necessary, and the resulting impact on the operating budget in terms of the level of services performed by the local government. A balance must be reached that neither deprives the community of necessary capital improvements, nor deprives it of equally necessary public services.

The accurate picture of the debt capacity of the municipality cannot be accurately assessed without a close examination of the debt structure of the related overlapping governmental units. If it is important to coordinate the land use and transportation patterns of metropolitan areas, an equally compelling argument can be made for the coordination of fiscal policies related to debt.

Although the debt limit for any one governmental unit may be financially prudent, the sum total of all debt that must be supported by the average taxpayer may be unduly harsh and burdensome. Obviously, borrowing proposals on the part of any one unit of government should be coordinated with the existing debt and proposed future borrowing of all other units.

Capital Improvements. The financial analysis should also include a study of past capital expenditures. Although such an analysis is of little use for projecting future capital needs, it is useful in determining the past policies of the municipality in providing improvements, and in discovering what, if any, emphasis has been given to various classes of improvements. Care must be taken so as not to confuse the difference between a study of capital expenditures and past debt. All past public improvements may not have been financed by borrowing and the two studies may be quite different.

Some idea of the magnitude of future capital expenditures (as well as the costs of other governmental services) can be reasonably ascertained by developing future estimates of capital needs that are based on basic planning studies of population, land use, density, and level of services. Although the techniques and study methods have been developed with new suburban areas in mind, the fundamental concepts that have been developed are equally valid for estimating the costs of improvements in developed areas as well. Perhaps the two "classic" studies are W. Isard and R. E. Coughlin's Municipal Costs and Revenues Resulting From Community Growth (Chandler-Davis, 1957), and W. L. C. Wheaton and M. J. Schussheim's The Cost of Municipal Services in Residential Areas (Wash. D.C.: GPO, 1955). Other studies are cited in ASPO Planning Advisory Service Information Report No. 114, Annexation Studies (September 1958). The techniques used in these various studies will not be discussed here since they are easily obtainable. However, it should be emphasized that their usefulness is not limited to annexation studies.

Estimating the costs of proposed capital improvements that are proposed in the comprehensive plan is a difficult task, but it is not impossible and is necessary if comprehensive plans are to be meaningful in a financial, if not realistic, context. Examples for the smaller city can be found in the comprehensive plans prepared for various communities by the Pittsburgh Regional Planning Association, and for the large city in the new comprehensive plan for the city of Philadelphia.

Fiscal Policies

The information gathered in the course of the financial analysis is undoubtedly of great use to the planner when he is proposing either capital improvements or analyzing the capital improvement program. However, the basic information only can serve as a very rough guide to action. If the planner leaps into capital programming with only raw financial data to guide him, he runs the risk that recommendations will be ignored if they do not coincide with implicit opinions concerning fiscal policy that are held by either the chief executive or the legislative body. Consequently, a clear, explicit and definite series of policy statements should be developed as guides in capital programming.

Policy statements should try to outline the policy of local government concerning the following illustrative points:9

1. Amount of funds that can be expended annually for capital improvements.

2. Annual amounts that shall be financed from General Funds or through borrowing.

3. The terms and conditions under which self-liquidating capital improvements shall be undertaken.

4. The terms and conditions under which the City should accept outside assistance for the financing of improvements (for example, State Aid and Federal Aid).

5. The types and maturities of bonds to be issued by the City for the financing of capital improvements.

6. The feasibility of earmarking year-end surpluses of money for capital improvements.

Since these types of policy questions are only meant to be illustrative, a number of specific policy statements perhaps could show how they may work in practice. For example, the formulation of Philadelphia's 1961–1966 capital program was guided by the following major points of fiscal policy:10

1. Project analysis — There is a clear separation between self-supporting and tax-supported public works. All projects financed by self-supported loans must clearly demonstrate ability to produce sufficient revenue to repay their cost. There is careful analysis of proposed projects as to justification, scheduling, cost estimates and the effect on the operating budget.

2. Limited borrowing — New tax-supported loans plus "pay-as-you-go" capital financing may not exceed $25 million in any one year of the six-year capital program.

3. Pay-as-you-go financing — In the 1961–1966 Capital Program, ten per cent of the cost of all tax-supported projects will be paid for out of current operating funds. For sewerage and waterworks projects "pay-as-you-go" financing is scheduled at $775,000 and $675,000, respectively, for each year of the program. These amounts represent an increase of $50,000 each year over the previous program. The parking program for outside center city is financed by an annual appropriation of $500,000 from current general funds.

4. Ceiling on annual debt service charges — Annual debt service charges payable from the General Fund are not to exceed 20 per cent of the total General Fund revenues (currently 14 per cent). This ceiling on annual debt service charges is in accordance with recognized finance principles. A proper relationship to the operating budget is likewise essential.

5. Limited bond life — Bond issues are of the serial type and general obligations of the City. The self-sustaining Water and Sewer bond issues have a maximum maturity of thirty years. Tax- supported loans mature within twenty-five years.

6. Borrowing reserve — A borrowing power reserve is to be maintained to meet emergencies.

7. Outstanding debt — The outstanding debt of the City will be leveled off and reduced at the earliest possible date. Capital expenditures under the six-year improvement program are carefully scheduled to insure a reasonable outstanding debt structure in relationship to the community's economic base, valuation of assessable property and ability to pay.

A similar list of policy statements, although perhaps less extensive, is found in the capital program for Fairfax County, Virginia.11 These statements are referred to in the report as "rules of financing capital improvements." The four basic rules are:

1. Capital improvements and debt service costs should equal about 20 per cent of the total budget.

2. Debt service costs should not exceed 25 per cent of the total budget.

3. At least 20 per cent of capital improvements should be financed from current revenues.

4. At least 25 per cent of debt principal should be scheduled for retirement within the current and succeeding four years.

Financial Framework for Capital Programming

In summary, financial analysis and planning is needed for intelligent capital improvement programming. The three basic elements that need to be clearly understood include: first, the relationship between the revenue program (based upon the economic vitality of the community) and the operating budget (based upon a program of public services) with the resulting cash funds available to pay cash in whole or part for capital improvements or to meet the obligations of debt service; second, the debt structure of the community and its ability to incur new debt; and third, policy statements dealing with revenues, operating expenditures, capital improvements, bonds, and the relationships among and between them.

CAPITAL PROGRAMMING PROCEDURES

Role of the Planning Agency

The professional planning staff, if the locality has one, functions as a reviewing, coordinating, and recommending agency. In some respects, the planning agency acts as a clearing house for projects and interjects judgments that it is uniquely qualified to render.

In localities where the programming of improvements is optional, and not required by law, the planning commission may be guided by these considerations:

1. Effective compilation of proposed improvements necessitates active relationships and cooperation with operating departments, the chief executive, the legislative body, and the public at large. Thus, the planning agency can become an integral part of local government, rather than an often-ignored appendage.

2. The planning commission may discourage proposals for expenditures that would not be in harmony with the comprehensive plan of the community.

3. The capital improvement program is tangible evidence of the work of the planning agency that is forcibly presented to the executive, the legislative body, and the public.

4. The translation of the overall goals for a community into the physical facilities proposed for that community is essential for effective planning to succeed.

The planning agency can utilize the capital improvement program as a major means of effectuating the plan for the community. At the same time, the community plan should be the guide for the acceptance or rejection of proposed capital improvements.

Thus, although the compilation of projects proposed by operating departments is of extreme value to the community, the planning agency can perform an even more important function. The planning agency can either have the responsibility for arranging capital improvements in order of priority, or can point out the implications to the development of the community as a whole so that the appropriate authority can make a more intelligent decision. In either case, the legislative body has the responsibility of decision-making in the final analysis.

General Procedure

The following steps, assuming legislative authorization, are generally followed in communities undertaking capital improvement programs. It is also assumed that the planning agency has accepted primary responsibility for the preparation of the program.

1. Public statement by executive officer — governor, mayor, city manager — that all operating departments are to submit proposed capital improvement projects to the planning agency. Usually, the date when these projects will be considered by the executive and legislative bodies is specified. The statement may also include any fiscal or general capital improvement policy statements. The executive officer might also invite proposals from citizens' organizations.

2. The finance office or officer undertakes an analysis of the financial status, and existing and potential resources of the community. At a later date, the planning agency may work with the finance agency in assessing the amount of funds that will be available to the community and what proportion will be available for capital improvements.

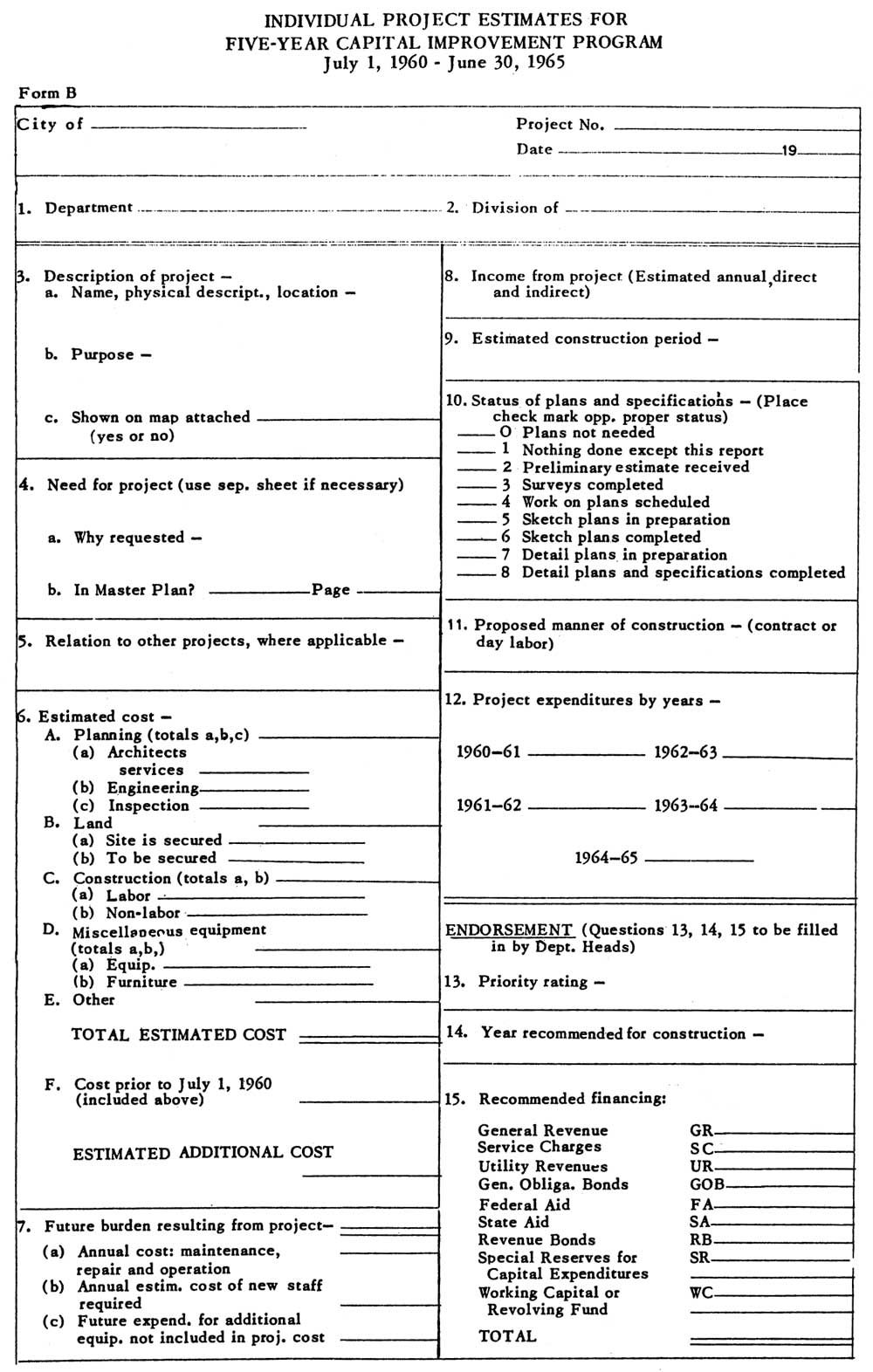

3. The planning agency takes the initiative in making contacts with the operating departments and requests that proposals for improvements be set forth according to certain standard procedures. The planning agency supplies the forms on which the proposals should be reported, and should also furnish a written set of instructions on the methods to be followed in filling the forms.

4. The planning agency may work with the operating departments in advising on the desirability of projects before they are formally submitted. The extent of such cooperative endeavors will be dependent upon the type of relationships established between the planning agency and the operating departments, and the time and staff resources of the planning agency.

5. After the operating departments formally submit their proposals, the planning agency should review these proposals and all assembled data in light of the development plan and policies of the community, as well as in the light of the financial prospects of the community. Any proposals from the planning agency and citizens' groups should also be reviewed, as well as taking into consideration the impact of the improvements that will be built by other governmental units in the area.

6. The planning agency should take the initiative in discussing the proposals with the operating departments, special intragovernmental committees, and interested citizens' organizations in order to clarify and redefine proposals if necessary. If the planning agency recommends omitting or postponing a project, reasons should be clearly stated.

7. The program, together with the pertinent data and planning agency recommendations, should be presented to the executive officer. After his review of the material, it should be formalized in published form.

8. The program should be submitted to the legislative body, together with the executive officer's budget message or report.

9. There should be public hearings and an opportunity for public review. Copies of the capital program report should be available to all interested citizens and civic groups, in addition to being distributed to legislators and operating departments.

10. After legislative action in adopting or rejecting proposals for capital improvements, funds must still be made available. (In rare cases, such as in Philadelphia, the capital budget and appropriation authorizations are combined.) Although a capital budget is adopted, there is another opportunity for reviewing the proposals at the time of appropriation of funds or voting for bond issues. Even after appropriations have been made, changes may still be made prior to construction.

Liaison with Departments

The planning agency will want to establish certain procedures for requesting information from operating departments, and for the cooperative working out of the capital program. As soon as the planning agency has been given responsibility for the program's preparation, a set of forms should be devised for use by the operating departments in reporting proposed projects. The planning agency should also prepare a written statement on the meaning of the program, instructions on completing the forms, and such information as the date of submittal, number of copies to be returned, and any other pertinent guides to complete an accurate reporting of proposed projects. The instructions should go into detail on each question of the form. For example, when asking information on estimated construction costs, the instructions may specify that the estimate should be one furnished by independent bids or estimates of the department; or the form would include a question to identify the person who made the estimates.

The planning agency should invite the operating departments to discuss proposals at any time with a designated member of the planning staff, and should indicate that a member of the planning staff will review with the operating department staff the proposals after they have been formally submitted. The planning agency should frequently stress its willingness to make available pertinent data, advise on the relationship between projects from different departments, and also show the relationships between suggested projects and the comprehensive plan. The planning agency should strive to be in a position whereby it is consulted when projects are in the idea stage and in generalized form prior to the development of detailed plans. It should also have the confidence of the operating departments that would enable it to originate suggestions for capital improvements which could be incorporated into the programs of the operating departments.

Preferably, the planning agency will establish relationships with the governmental agencies that are outside the municipal government. For example, there may be a school district with separate bonding power, separate park or sewage disposal districts with similar independent powers, and a number of health and welfare agencies, hospitals, and universities as well. Both for the purpose of analysis and for general public information, it is most helpful to present a picture of the proposed capital improvements for the urban area as a whole.

Proiect Information Submitted to Planning Agency

The planning agency needs certain information on each proposed project before it can analyze the type and importance of the project in comparison to other proposals. This information com.es from the departments on standard forms (a few forms are reproduced in the Appendix). The amount of information requested from the departments should be related to both the habits of the community officials and the usefulness of the date to the planning agency. The agency should not seek information it does not intend to use or that, because of limited staff time, it cannot tabulate and analyze. A check list in the Appendix is suggested for use by the planning agency in formulating its standard form for departmental reporting.

The Capital Improvement Program Report

One of the major tasks of the planning agency, after gathering the data and making recommendations on the relative importance of the projects, is to make the information available to the legislative and executive bodies, as well as to interested citizens. All the information that was gathered from the departments need not be presented in detail in the report, although some of the written descriptions of the projects may be incorporated in the text. The report will generally consist of four parts: (1) the overall summary of proposed projects, compared to the sources of financing, (2) a description of the methodology followed in preparing the program, (3) the descriptive analysis of types of facilities proposed, together with photographs or sketches, and (4) the detailed tables, listing each project and the decisions made on these projects.

Whenever possible, the reasons for including proposed projects should be indicated along with reasons on why they received a particular priority. This should be done regardless of whether the planning agency or operating department assigned the priorities.

The nature, format and length of the report will vary with the size of the city, number of projects, staff qualifications and time available, and the amount of money allotted for publication. Following are some suggestions on what data should be presented and how to do so. These may be combined in differing fashion covering various periods of time.

1. Proposed projects should be mapped. This may be done on a series of maps, one showing proposed street improvements, the next showing park and playground improvements, etc., or it may be done on a composite map showing all improvements in the city. If this is done, projects should be differentiated by symbols or colors. Mapping as an aid to preliminary analysis has considerable value in the study of the concentration or dispersal of improvements, in pointing up duplications or gaps in proposals, and in revealing glaring inconsistencies or negation of purposes of the projects. Mapping is also a good tool for public relations.

2. The six-year program should be tabulated by departments and year of scheduling. Each project within each department should then be tabulated on more detailed tables. Information in the table should include total cost of the project, allocation of cost in each year of the capital program, and any amount that must be spent after the capital program period.

3. A summary of all projects in the capital budget (first year of capital program).

4. Tabular presentation of projects by status: recommended, under contract, in progress, completed.

5. Presentation of projects by source of funds. This could be done by distinguishing among assured funds, expected funds, and uncertain funds. Or in more detail by distinguishing, for example, among special assessments, federal funds, state funds, bond issues, etc.

6. Comparison between number of projects recommended last year and estimated costs, to the number of projects actually constructed and actual costs.

7. Tabular listing of projects not included in present program. Possible future action to be taken.

8. Tabular and graphic comparison of proposed program and improvements called for by the comprehensive plan.

9. Graph of total income and expenditures of city for past years and future estimates.

10. Comparison of request for capital improvements to funds for operating departments, by departments.

11. Graph of outstanding bonds to date of liquidation and effect of new issues on debt capacity.

THE PROBLEM OF PRIORITIES

The most difficult problem in capital improvement programming is that of establishing priorities for the various improvements which have been proposed. How does one determine within a limited budget which is more important — a new bridge, a new sewage-treatment plant, an addition to city hall, or a new swimming pool? Theoretically, from the planner's point of view, proposed improvements should be evaluated to determine if they are in conformance with the comprehensive plan. Thus, each project would be viewed in terms of its location, size, service provided, relationship to its service area, effect on surrounding land uses, effect on transportation facilities, effect on density patterns, conformity to standards contained in the plan, relationship to planning policy, and conformity to the community's goals. However, the plan is often of limited usefulness as a strong guide. More often than not, the plan is of a very general nature and cannot provide hard and fast guides to decisions. Since few plans ever are carried to the point of tracing many of the financial implications of their recommendations, their usefulness in the stark world of municipal finance can be severely curtailed. In addition, many communities do not have a comprehensive plan, some plans are woefully out of date, and others are still in preparation. Thus, there must be standards for evaluation in addition to that of agreement with the comprehensive plan.

The basic decisions that must be made in determining priorities are:

1. Which projects will be included in the six-year program?

2. Which projects will be included in the first year?

3. What proportion of funds will be spent in various functional categories in both capital program (six years) and capital budget (first year)?

Some authorities on capital programming suggest that it is first necessary to make decisions concerning priorities within a specific function, and then make decisions on the relative merits among the functions. This procedure would emphasize departmental planning with resulting priorities, with the planning agency being primarily a synthesizer. Thus, many small plans are combined to create a large plan. Another approach emphasizes broad goals, such as deter- mining the total amount that will be spent on capital improvements, as well as the relative proportion that will be spent in each functional category. The projects are then apportioned within each functional group with direct comparison between individual departmental requests at a minimum.12 Actually, each of these approaches are abstract outlines of points of view that must be integrated into a single, although admittedly complex, state of mind when approaching the programming process. Thus, departments must set priorities within their own area of interest. An overall and functional financial framework must be tentatively worked out. The planning agency must examine and perhaps alter departmental priorities with a view toward both internal and total program consistency within the tentative financial framework. The agency then may suggest changes that are necessary. In addition, although the planning agency wants to avoid comparing projects from different functional groups, it still may be necessary to compare the relative merits of a street widening and a playground. In the end, a program will emerge. However, the planning agency should strive for a systematic method in which to work since more intelligent decisions may result, and unnecessary frustration can be avoided. Whatever method is used, the planner should use it as a guide, not as a substitute for decision-making.

Criteria for Establishing Priorities

Various criteria for establishing priorities for capital improvements have been proposed. These usually have been in a generalized fashion and tend to emphasize intangible values. For example, the National Resources Planning Board suggested the following:13

- Protection of life.

- Maintenance of public health.

- Protection of property.

- Conservation of resources.

- Maintenance of physical property.

- Provision of public services.

- Replacement of obsolete facilities.

- Reduction of operating costs.

- Public convenience and comfort.

- Recreational value.

- Economic value.

- Social, cultural and aesthetic value.

- Promotional value through effect on future development.

- Relative value with respect to other services.

Earlier (in 1935), the Michigan State Planning Commission listed the following factors to be considered in determining the priority of projects:

- Employment situation.

- Extent of development of local natural resources.

- Portion of project beneficial in direct employment.

- The financial stability of the local government unit.

- The financial setup of the project (as to self-liquidating features).

- The suitability of the project as to its local environments.

- Other considerations of geographic and economic factors.

- The local preparedness for the project, such as ownership of sites, development of plans, etc.

- Public safety.

- Social desirability.

- Injurious economic competition.

- Length of time involved in project, and ability to taper off at the end.

- Divisibility of project into jobs manageable by small building interests.

A shorter, more recent list of items to be considered appears in Municipal Finance Administration:14

- What is the relationship of the project to the welfare and progress of the entire city?

- How many citizens will be helped by it and how many citizens will be harmed or inconvenienced if the project is not constructed?

- Will it replace a present outworn service or structure or is it a new venture?

- Will its construction add to the city's operation and maintenance budget or will the project be largely self-supporting?

- Will it add to the value of the area and thereby increase the valuation of city property?

- Is it estimated cost within the city's ability to pay?

A recent federal publication, Planning for Public Works,15 emphasizes three main factors in priority scheduling. They are: (1) relative deviation from standards, (2) essentiality of service, and (3) time of need.

Under the first item, it is first necessary to develop standards of service that the community wishes to meet. For example, it may be decided that no child should be required to walk more than one-half mile to an elementary school, or that a playground should be within walking distance of 15,000 people. After the standard is established, proposed improvements are measured against it to determine which phase or program of the municipal government is most in need of improvement. Thus,

Everything else being equal, within any single functional field, the segment of need showing the greatest deviation from the established standard should receive the first priority. Among functional fields, that field which is farthest behind in meeting its standards — everything else being equal again — has the highest relative urgency.16

There is, of course, the problem of using standards that are partially based on serious studies, and partially based on the folk wisdom of the planning profession. Using standards that are based more on intuition than on careful analysis of needs may make this particular method appear far more "scientific" than it really is. (The problem is ably discussed in Planning Municipal In- vestment,17 the first book-length study of capital improvement programming to appear. The work deals with Philadelphia and is perhaps "must'' reading for anyone seriously interested in capital programming.)

Measuring deviation from standards may be an adequate technique within a given area of service. However, to make comparisons between different areas of service (e.g., parks vs. highways), the concept of "essentiality of service" is introduced. A decision must be made about how essential one function is in comparison with another.

For example, a community may face this situation: It has a school building condemned as dangerous for occupancy. Its filtration plant is outmoded and cannot deliver safe water in sufficient quantity. Its hospital is too small; it could use a new city hall; and some of its streets are unpaved. And, it has no golf course.

Using only the index of deviation of standards, the first project to be built would be the golf course since the deviation is 100%. Obviously the golf course will not be and should not be the first new facility...

...The weights attached to gauge relative essentiality among services are not often capable of exact measurement — at least not in the way in which functional standards are determined. Some services are obvious prerequisites if the community is to survive. Others help in supporting essential service but are not in themselves critical. Still others provide the amenities of life, and while desirable, they are not essential.18

The time of need is brought into the picture to round out this system of priority determination.

Functions with low deviations at the present may face growth situations which will cause them to fall behind in the very near future, and those with high deviations now may face a stable demand. To equalize deviation over the entire period, all services should be brought along at about the same rate. Generally speaking, backlogs and current needs will still be given precedence in developing a list of relative urgencies. Exceptions become necessary, however, when the time factor is considered and the function facing the greatest demand in the immediate future may take precedence over that with the largest actual deviation.19

Some attention has been given to mathematical formulas as a method of determining priorities. Usually these are limited to establishing the relative importance of projects within the same functional group. For example, in developing a proposed capital improvement program for Arlington County, Virginia, a scoring system was used in determining priorities within three functional groups: neighborhood and collector streets, storm sewers, and sidewalks.20

Street priorities were based on actual use. In each case, a priority score was established by dividing the 24-hour traffic volume flow by the width of the pavement. Scores varied from a high of 111 to a low of 11. Similarly, priorities for sidewalks were based upon the relative exposure of pedestrians to traffic. Pedestrian and traffic counts were made over a period of time for each project. Scores were developed by multiplying the number of pedestrians by the average number of vehicle exposures per pedestrian. These scores ranged from a high of 1,186 to a low of 26.

In addition to comparing projects with the sewer plan, Arlington County's storm sewer priorities were developed by using the following scoring system:21

| CONSIDERATION | WEIGHT PERCENTAGE | SCORE RANGE |

|---|---|---|

| Hazard to Human Life | 20 | 0–20 |

| Property Damage Hazard | 20 | 0–20 |

| Time – Construction – Economy | 15 | 0–15 |

| Technical Considerations | 10 | 0–10 |

| Nuisance Aspects | 10 | 0–10 |

| Reclamation Benefits | 10 | 0–10 |

| Intangible Factors | 10 | 0–10 |

| Neighborhood Equity | 5 | 5–5 |

Other types of devices to determine priorities more accurately and objectively include economic analysis (goal is to achieve economic efficiency), rate-of-return analysis, cost-benefit analysis, and cost of public funds analysis.

However, these techniques are too complex to discuss in a report of this length. In addition, most of them are still in experimental stages, deal almost exclusively with economic factors at the expense of equally important noneconomic factors, need significant amounts of data in order to be applied, require highly skilled professionals to conduct them, and are as yet quite limited in their usefulness to the capital programming process as a whole.

The average planning staff is advised to approach such techniques with great caution since the time invested in such a process may not necessarily result in better choices of improvements to include in the program. Satisfactory results can still be achieved by using some of the more traditional and more simple methods of determining priorities. Many cities still rely on a simple system similar in many respects to the following categories of relative priorities:22

| Essential (highest priority) | Projects which are required to complete or make fully usable a major public improvement; pro- jects which would remedy a condition dangerous to the health, welfare and safety of the public; projects which would provide facilities for a critically needed community program. |

| Desirable (2nd priority) | Projects which would benefit the community; projects which are considered proper for a large progressive community in competition with other cities; projects whose validity of planning and timing have been established. |

| Acceptable (3rd priority) | Projects which are adequately planned, but not absolutely required by the community if budget reductions are necessary. |

| Deferable (lowest priority) | Projects which are definitely recommended for postponement or elimination from the Capital Budget or Capital Program since they pose serious questions of community need, adequate planning or proper timing. |

As can be readily observed, most of the criteria that have been mentioned describe "intangible" community goals, and are not subject to precise measurement. However, by setting forth even these very generalized criteria, the planning agency and the community may better assess the relative success of each proposed project in attaining these goals.

Since there is at present a lack of scientific methods of weighing and comparing various intangibles, perhaps the main role of the planning agency is that of pointing out the implications of alternative projects to the executive and legislative bodies. These groups are bound in the last analysis by the "standard" of the public official: will the proposed improvements be acceptable to the voters of the community?

When pointing out the implications of various proposed projects, the planning agency might approach this problem on the basis of what the community needs most to achieve its economic, social and cultural function. If the community needs to protect its economic base and needs to make itself more attractive to industry, what improvements would be of most value to industry? For example, if the highway department proposes a new thoroughfare and the water department says that a primary requirement is a new pumping station, the planning agency may point out that the priorities of these projects will be dependent upon the needs and requirements of industry. The planner should indicate whether additional transportation facilities or a more adequate water supply is most important to existing, expanding or new industries. The relative impact of each improvement would be assessed and an appropriate recommendation would be made. As another example, if both a new police station and new swimming pool are proposed, the planning agency can raise the following types of questions: What types of crime and delinquency are prevalent in the community? Is a large source originating from the teen-age and juvenile groups? If so, would positive means of providing alternatives to crime, i.e., recreation, be more desirable than protective measures such as the police station? If positive incentives to recreation are desired, would the swimming pool draw a larger number of people than an alternate type of facility such as a gymnasium? These are simplified examples of ways that planning can be of assistance to the legislative and executive bodies in decision-making.

In concluding this discussion of determining priorities, it must be emphasized that no written or mathematical formula can be substituted for human judgment. In the final analysis, the planner must exercise his best professional judgment, while at the same time realizing that in government "...the actual choice and establishment of final priorities are still accompanied by the political process of compromise, a give-and-take between all groups concerned."23

LEGAL AUTHORITY OF CAPITAL IMPROVEMENT PROGRAMMING

The planning agency, although it may be empowered to prepare the capital improvement program, and although it may have the authority to determine what may be included in that program, does not have the final decision on capital improvements for the community. This power is shared in varying degrees by the legislative body and the chief executive. However, the degree to which the planning agency shares responsibility for the program's preparation, and the degree to which the planning agency's recommendations must be adhered to, varies considerably. The following extracts from local charters and legislation illustrate these differences:

DENVER (Ordinance No. 391)

-9- CAPITAL IMPROVEMENTS BUDGET COMMITTEE.

-9-.1 Establishment. There is hereby established a committee which shall be known as the Capital Improvements Budget Committee, hereinafter in this section referred to as the "committee."

-9-.2 Membership: Appointment. The committee shall consist of twenty-three members, each of whom shall be a qualified elector and none of whom shall be an officer or employee of the City and County of Denver: eleven members thereof to be appointed by the Mayor, three members thereof to be appointed by the Chairman of the Planning Board of the City and County of Denver from the membership of said Board, and one member thereof shall be appointed by each member of the Board of Councilmen from among the qualified electors residing in the councilman's district from which he is elected.

-9-.7 Procedure.... The committee shall meet no less than twice monthly from April 1 to September 1 of each year and the approved capital program and budget shall be submitted to the Mayor in accordance with the budget calendar.

-9-.8 Powers and Duties. The committee shall have the following powers and duties to-wit:

-9-.8 (1). The committee shall be responsible for receipt, evaluation, approval, disapproval or modification of the requests for capital improvement and capital assets as submitted annually by the Planning office after that agency has coordinated the physical planning of projects within the text of the comprehensive plan, and reported formally to the Capital Improvements Budget Committee.

-9-.8 (2). Evaluation, approval, disapproval or modification of any project shall be, insofar as possible, premised upon the comprehensive plan, or parts thereof. as amended from time to time, of the City and County of Denver. Each agency or department, whose requests have been disapproved or modified, shall be permitted to be heard before the committee for reconsideration.

-9-.8 (3). The committee shall recommend to the Mayor those capital improvements and capital assets which should be considered in the ensuing six-year period, and those which should be deferred beyond.

-9-.8 (4). The committee shall also recommend to the Mayor those capital improvements and capital assets which should be considered in the next ensuing fiscal year.

-9-.8 (5). The committee shall also recommend to the Mayor a method to finance the approved capital program; minority reports, if any, shall be included.

-9-.8 (6). The committee shall review the approved capital program and shall report annually to the Mayor and council on the progress of such program.

OMAHA (Charter Provision)

SECTION 7.07 CAPITAL IMPROVEMENT PROGRAMMING: Each department or agency annually, on or before a date which the Mayor shall establish, shall submit to the Planning Director a schedule of all capital improvements which it recommends be undertaken in any of the six succeeding years. The Planning Director shall examine each project for conformity with the master plan and shall prepare and submit for Planning Board approval a consolidated schedule of the projects pro- posed by the departments showing the character and degree of conformity or non-conformity of each project as it relates to the master plan. Not later than ninety days prior to the date of certifying the tax levy, the Planning Department shall submit the consolidated schedule of projects to a Capital Improvement Priority Committee composed of the Mayor as chairman, the City Attorney, the Finance Director, the Planning Director, and the Public Works Director. The Capital Improvement Priority Committee shall formulate and recommend a six-year capital improvement program showing exactly which projects should receive appropriations in each of the six succeeding years. As a part of his annual budget, the Mayor shall after consideration of the capital improvement program, submit to the Council his recommendations with respect to the capital budget; for the ensuing year The Council shall not appropriate in any budget or during any budget year any money for any capital improvement project which has not been referred to and reported on by the Planning Department as to conformity to the master plan. If the department fails to render any such report within thirty days, or within such longer period as may be granted by the Council, the approval of the department may be presumed by the Council.

NEW YORK (Charter, Chapter 9)

Report of comptroller

212. Not later than the fifteenth day of August in each year, the comptroller shall submit to the board of estimate, to the council, to the city planning commission and to the director of the budget, a report which shall be published forthwith in the City Record, setting forth the amount and nature of all obligations authorized on account of each pending capital project, the liabilities incurred for each project outstanding on the first day of July and setting forth and commenting in detail upon the city's financial condition and advising as to the maximum amount and nature of debt which in his opinion the city may soundly incur for capital projects during each of the six succeeding calendar years, and containing such other information as may be required by the city planning commission or by law.

Departmental estimates for capital projects

213. On such date as the mayor may direct, but not later than the fifteenth day of August, the head of each agency shall submit to the city planning commission and the director of the budget a detailed estimate of all capital projects pending or which he believes should be undertaken within the six succeeding calendar years. Such estimates shall be known as departmental estimates for capital projects and shall be in such form and contain such information as may be required by the city planning commission, by the director of the budget or by law. Such departmental estimates shall be public records and shall at all reasonable times be open to public inspection....

Certificate of the mayor

215. Not later than the fifteenth day of September, the mayor shall submit to the city planning commission the report of the director of the budget, together with the mayor's certificate as to the maximum amount of debt which in his opinion the city may soundly incur for capital projects during the ensuing calendar year with his recommendations as to the capital projects to be included in the capital budget....

Proposed capital budget and program; submission

217. Not later than the first day of November, the city planning commission shall submit to the board of estimate, to the council, to the director of the budget and to the comptroller a proposed capital budget for all authorizations recommended to be adopted for the ensuing calendar year the aggregate amount of which shall not exceed the amount specified in the mayor's certificate, and a capital program for the five calendar years next succeeding such ensuing calendar year, both of which shall be published forthwith in the City Record.

Capital budget; adoption by board of estimate

221. Between the twenty-fifth day of November and the fourth day of December, both inclusive, the board of estimate shall adopt a capital budget for the ensuing calendar year. Should the board of estimate fail within such period of time to adopt such capital budget, it shall be deemed to have been adopted in the form submitted by the city planning commission.

The capital budget shall specify the capital projects which may be undertaken during the ensuing calendar year and shall fix the maximum amount of new obligations of the city which may be authorized during such year to be incurred on account of each such project and each pending project and the nature, terms and maximum amount of the obligations which the comptroller may be authorized to issue for the liquidation of such liabilities.

The board of estimate may include in the capital budget any capital project which was included by the city planning commission in the capital program. It may, not less than fifteen days prior to the adoption of the capital budget, request the city planning commission to furnish, with respect to a project not included in the capital program, information similar to that included in said program with its recommendations. Such information shall be submitted within ten days and shall be published forthwith in the City Record. If the city planning commission recommends such project the board of estimate may include it in the capital budget. If the city planning commission does not recommend the project the board of estimate may include it only by a three-fourths vote. The board of estimate shall not adopt except by a three-fourths vote any capital budget pursuant to which obligations exceeding in the aggregate the amount stated in the mayor's certificate may be issued.

PHILADELPHIA (Charter)

Section 6-105. Annual Operating Budget, Capital Program and Capital Budget.

The Director of Finance shall: